If you’re entitled to public assistance, you might receive benefits like compensation from the Supplemental Nutrition Assistance Program or direct cash assistance. To obtain these benefits you have to go before a social worker and discuss your case. Making any false claims during that visit could result in a charge for welfare fraud if your obtain benefits you don’t deserve because of them.

Welfare fraud is described as making a false statement or misrepresenting your situation in a way that affects your eligibility. For example, if your spouse works but you do not, claiming that your home has no income since you have no income is a misrepresentation of your circumstances.

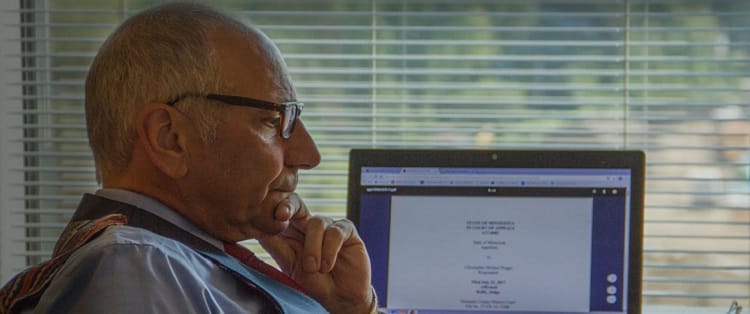

You must know that you’re committing a fraud to be convicted of it. For instance, if you accidentally inform the social worker that you brought in $20,000 in income last year but the true amount was $21,000, it might have been a simple mistake due to a misplaced pay stub or forgotten hobby income. On the other hand, claiming you only made $5,000 when you know you made $50,000 is fraudulent.

What are some penalties you face for welfare fraud?

Welfare fraud is a federal offense. If you get caught cheating the system, you will lose your cash assistance, subsidized child care or SNAP benefits for a period of time. On a first offense, you’ll lose cash assistance and subsidized child care for six months, while you’ll lose SNAP for 12. The penalties only affect the person who committed the fraud, not any other family members, which helps protect innocent parties from losing their benefits.

Accusations of welfare fraud put your benefits at risk and could impact your life significantly. Always take your correct pay stubs and information to the social workers, so you are certain of the information you provide.